Reports from other major industry players also indicate a positive outlook for the crypto market in 2025.

A favorable regulatory environment that will support the cryptocurrency market

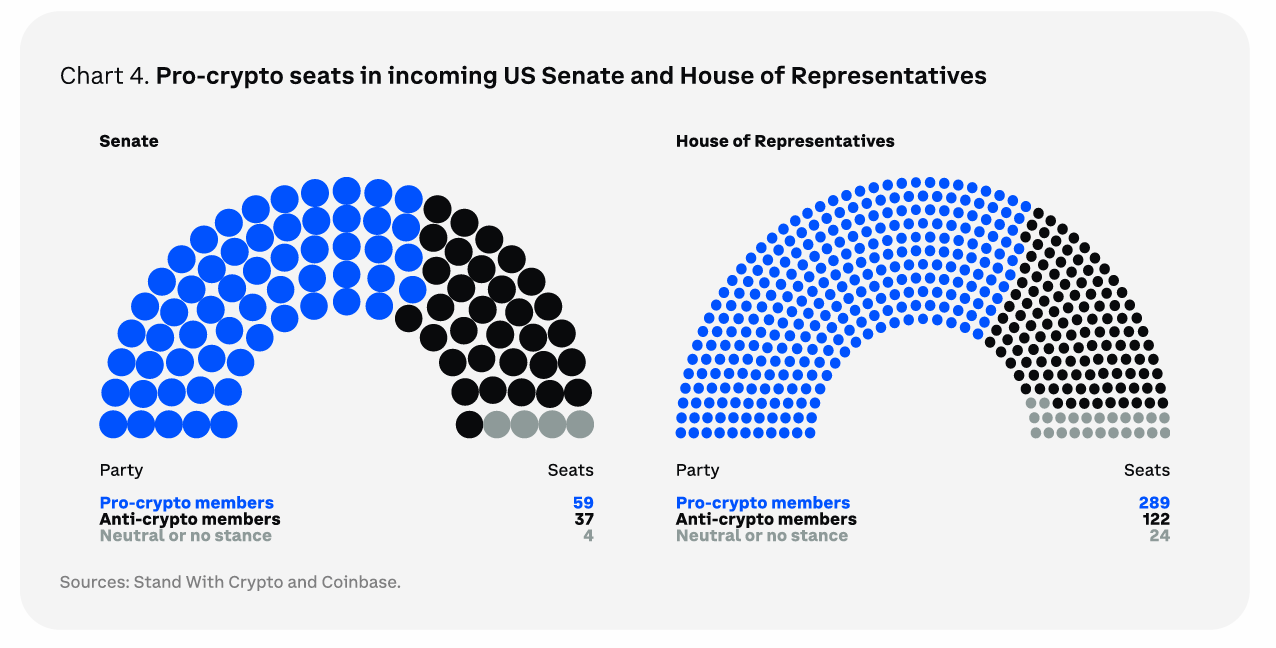

The first big prediction highlights that regulatory changes will benefit the entire crypto market. In particular, Coinbase describes the upcoming US Congress as “the most pro-crypto US Congress… in history”. Among the potential developments, the creation of a strategic bitcoin reserve could materialize.

It is also worth noting that pro-crypto movements are not limited to the United States; regions such as Europe – including France –, the G20, the United Kingdom, the United Arab Emirates, Hong Kong and Singapore are actively developing regulations to support digital assets.

Binance CEO Richard Teng also expects regulatory changes in the United States to act as a catalyst for growth in 2025, with other countries likely to follow.

Positive progress for crypto ETFs

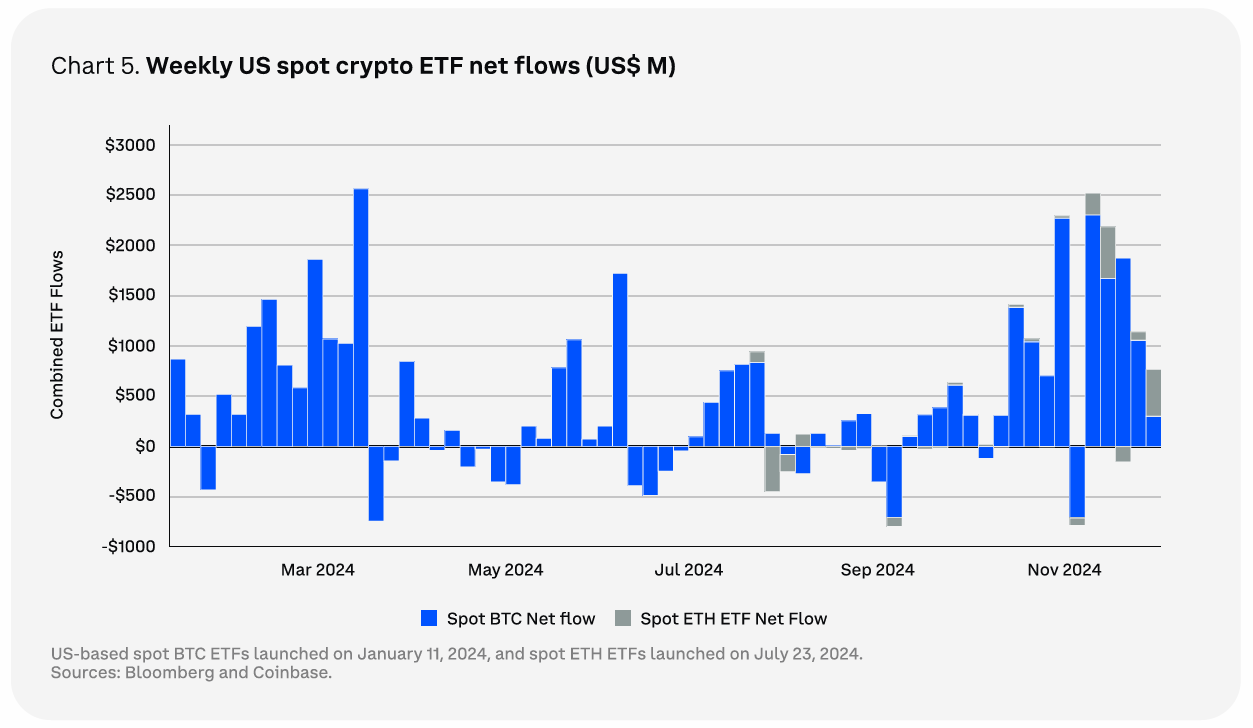

Coinbase highlights the importance of crypto ETFs, including Bitcoin and Ethereum, in raising new capital. The data reveals that net flows have reached $30.7 billion since their introduction.

The report also suggests that ETFs linked to assets like XRP, SOL, LTC and HBAR could gain approval, although their benefits may be short-lived.

Separately, Coinbase has speculated whether the SEC could approve ETF bets or eliminate requirements to create and pay out ETF shares in cash, potentially expanding the crypto ETF market. SEC Commissioner Hester Peirce hinted that this development could happen “soon.”

Global adoption of stablecoins

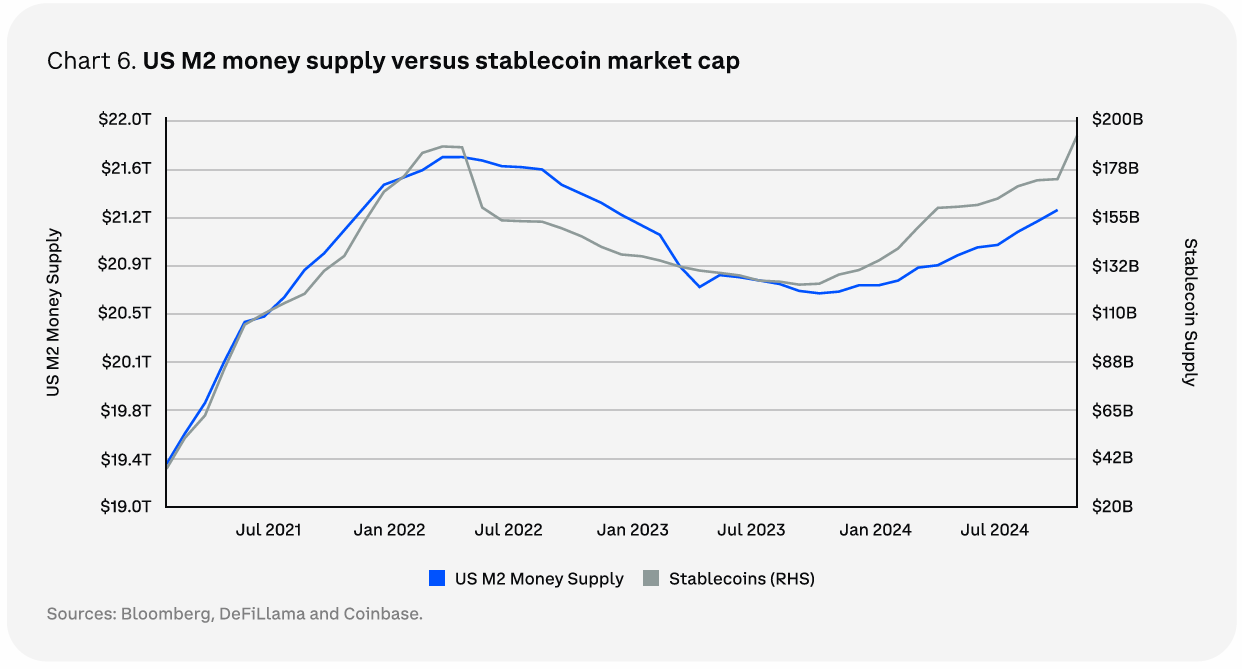

Coinbase suggests a very optimistic scenario for the adoption of stablecoins. With a market cap of over $190 billion, stablecoins currently represent 0.9% of the US M2 money supply.

In its report, Coinbase expects stablecoins to account for 14% of the $21 trillion US M2 supply, due to their speed and cost-effectiveness compared to traditional methods.

“In fact, we may very well be approaching the day when the first and primary use cases for stablecoins will no longer be just trading, but rather global capital flows and trading. » predicted Coinbase.

Tokenization, a booming sector despite regulatory issues

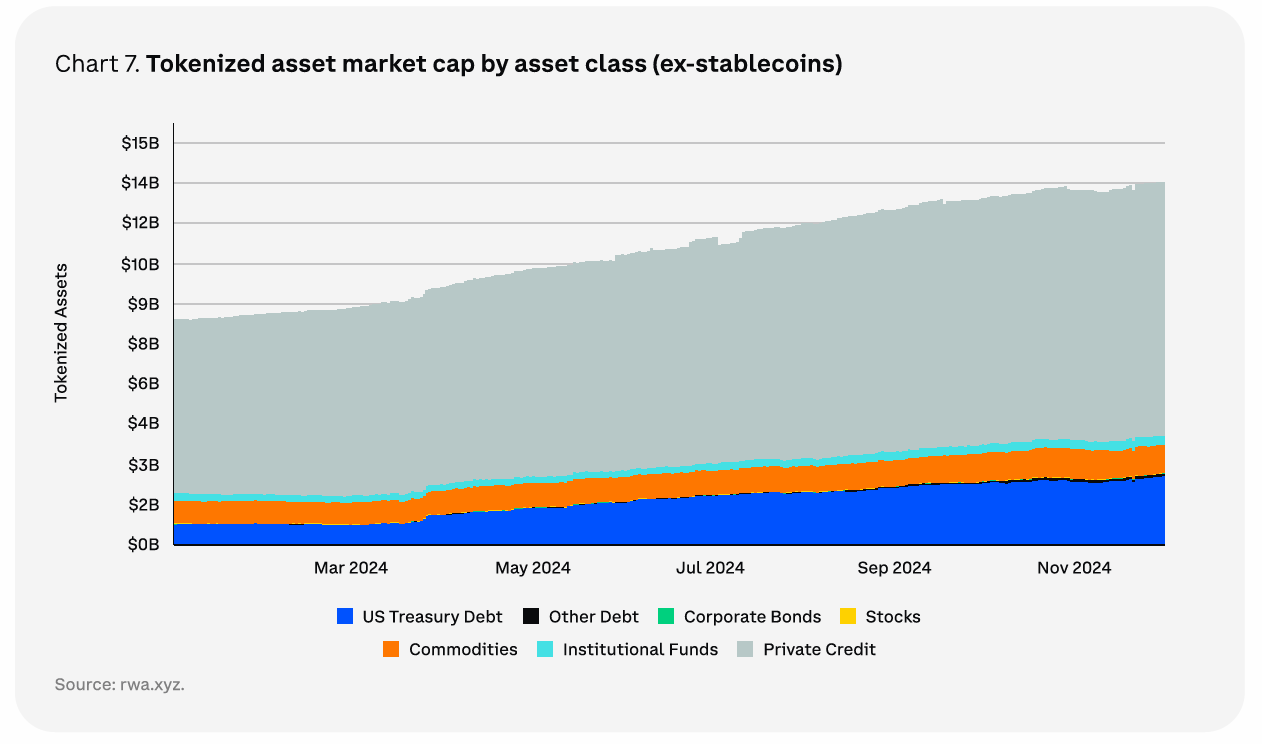

Coinbase expects tokenized assets to continue to grow in 2025. In particular, the capitalization of tokenized real assets (RWA) has increased by more than 60% over the past year, reaching nearly $14 billion.

Coinbase estimates that RWA’s capitalization could increase by at least $2 trillion over the next five years, backed by traditional financial giants such as BlackRock and Franklin Templeton.

The tokenization trend extends beyond traditional assets such as US Treasuries and money market funds to areas such as private credit, commodities, corporate bonds, real estate and insurance.

“We believe that tokenization can ultimately streamline the entire portfolio construction and investment process by putting it on the blockchain, although this may still take several years. Of course, these efforts face their own unique challenges, including the fragmentation of liquidity across multiple chains and lingering regulatory hurdles. » predicted Coinbase.

A report from Messari echoes these sentiments, predicting that Bitcoin and tokenized RWAs will dominate the scene in 2025.

A big reflection of DeFi in the heart of the crypto market

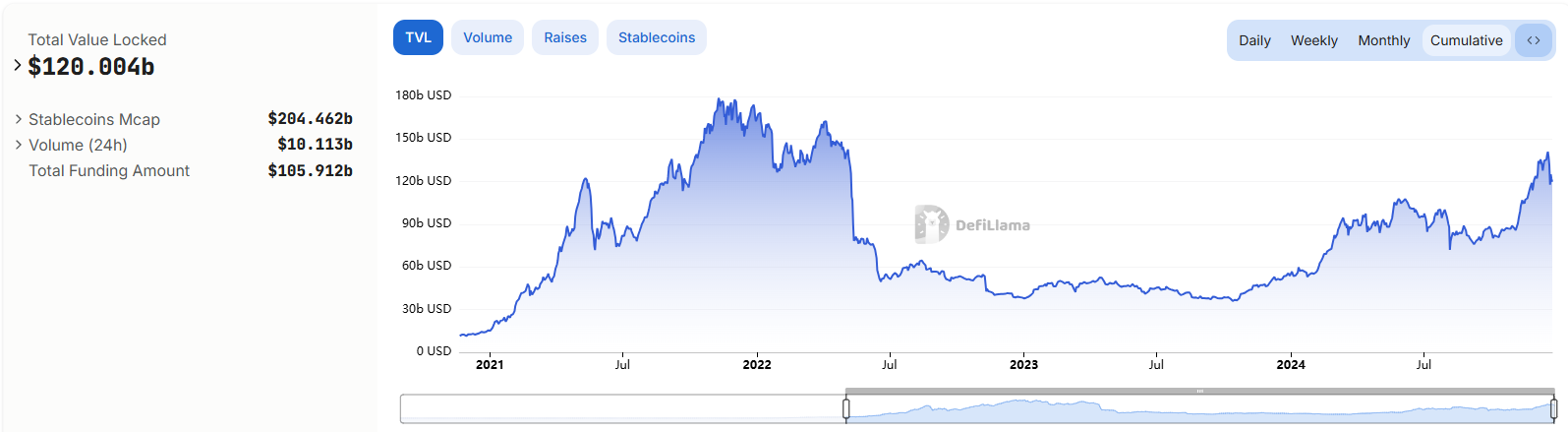

Despite the market capitalization exceeding $3.7 trillion, the total value locked (TVL) of DeFi (decentralized finance) has yet to return to its previous peak of $200 billion; it currently stands at $120 billion.

Coinbase says DeFi faced significant challenges during the last cycle as many protocols offered unsustainable returns. However, regulatory changes in the United States could allow DeFi protocols to share revenue with token holders, fueling a revival in the sector.

The report also refers to comments from US Federal Reserve Governor Christopher Waller, who explained that DeFi could complement centralized finance (CeFi) with distributed ledger technology (DLT) to improve data storage efficiency.

Moral of the story: The only crypto market prediction that matters for 2025 is the expectation of its participants.

Disclaimer

Disclaimer: In accordance with The Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent information. This article aims to provide accurate and relevant information. However, readers are encouraged to check the facts for themselves and seek professional advice before making any decisions based on this content.