Memecoins far ahead of other trends

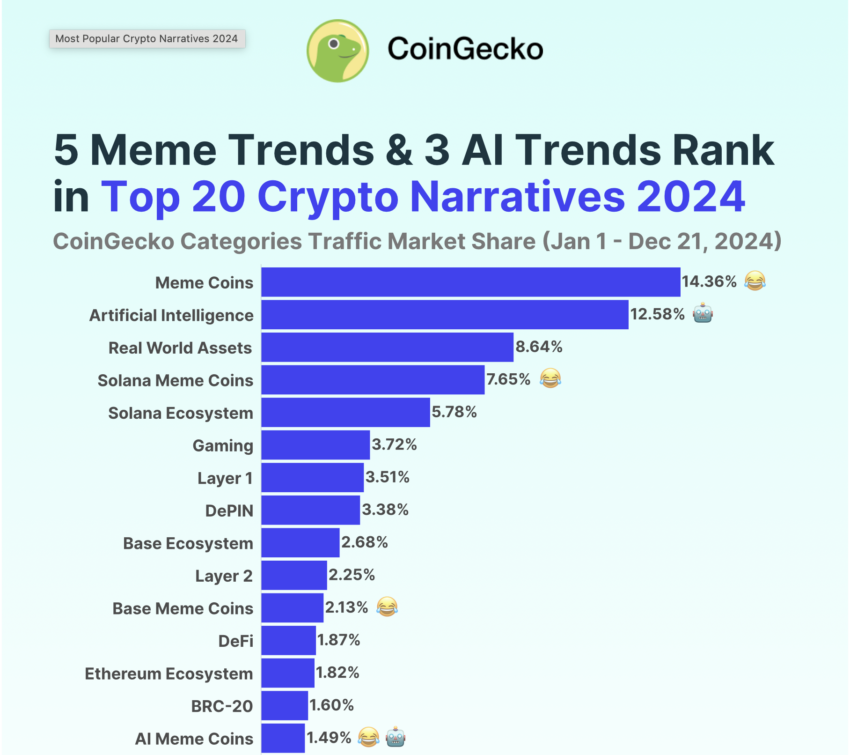

Memecoins literally crushed the competition this year. With 30.67% of total investor interest in 2024. Largely surpassing artificial intelligence, which also dominated in 2023. Within this memecoin-specific story, there is still a hierarchy with 14.36% interest for the category as a whole, 7.65 % for pieces genre based on Solana. This is followed by base memecoins (2.13%) and AI and cat themes which represent 1.49% and 1.19% respectively.

In one year, memecoins have moved up two places on the crypto trending chart, with investor interest increasing by 22.35%. Their success is also reflected in their capitalization, with nine projects now appearing in the top 100, including two in the top 20 and one in the top 10. These performances illustrate the enthusiasm for these assets, which will become essential in the market in 2024.

AI reduced but still influential

After dominance in 2023, AI gave way to memecoins and recorded a total interest share of 15.67%. The main AI narrative reaches 12.58%, while subcategories such as AI Meme Coins (1.49%) and AI Agents (1.17%) continue to attract investors.

While positive, these numbers reflect AI’s relative loss of popularity in the face of more speculative trends like memecoins. Nevertheless, artificial intelligence remains a key sector with lasting potential for technological innovation and the blockchain ecosystem.

Other trends to watch: RWA on the rise, DeFi and gaming on the decline

Tokenized real-world assets (RWA) are gaining momentum with 8.64% interest, a gain of 2.12 points compared to 2023. This positive development moves the story to third place in the ranking. DePIN networks are also experiencing significant growth with 3.38% interest.

On the other hand, stories related to gaming and metaversion show a dramatic decline. Gaming, which accounted for 10.49% in 2023, drops to 3.72%. Long considered a pillar of the crypto ecosystem, DeFi found itself relegated to 12th place with a meager 1.87% share. BRC-20 tokens, also in decline, only gained 1.60% compared to 7.10% in the previous year.

Memecoins: a trend that is not uniform

Memecoins continue to divide the industry. Arthur Hayes, former CEO of BitMEX, defends their role in attracting talent and attention to blockchains. He cites the example of Solana, where memecoins like BONK enabled a 75% increase in daily active users between late 2023 and early 2024.

However, this popularity is not uniform. Franklin Templeton points out that memecoins, despite their virality and potential for quick profits, remain extremely volatile assets with no intrinsic value. Vitalik Buterin, the founder of Ethereum, goes further and calls for the development of memecoins towards more meaningful projects such as immersive games on the blockchain.

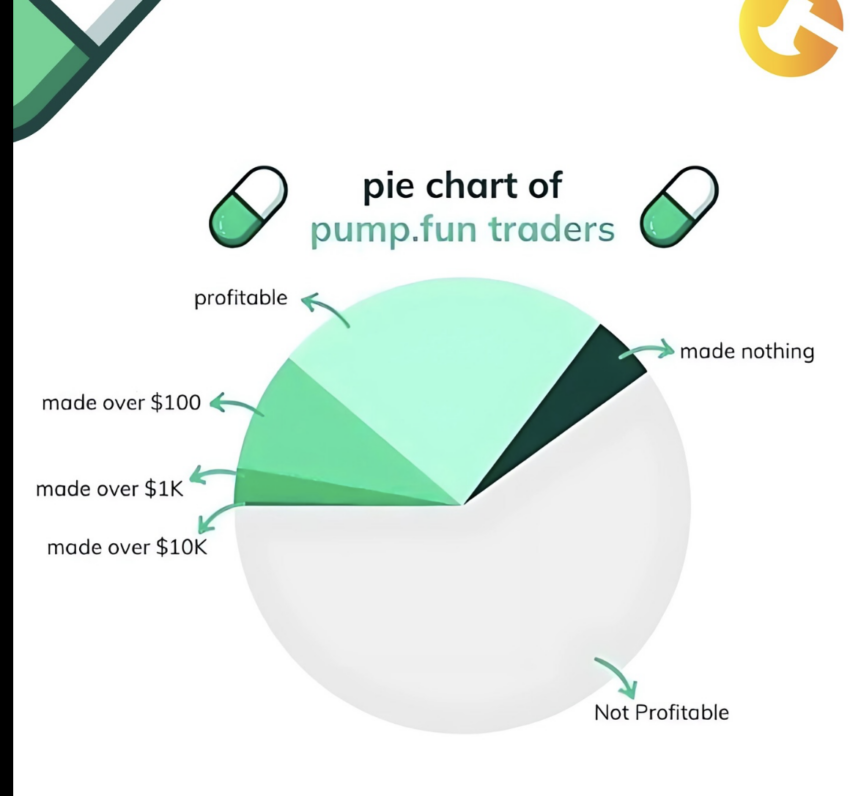

A recent study highlights the extreme volatility of these assets: 90% of memecoin traders lost money or made less than $100. Only 0.5% broke the $10,000 mark. These numbers are a reminder that despite their popularity, memecoins remain a risky bet for most investors.

Moral of the story: memecoins are like fireworks: they shine for a moment, but often go up in smoke.

Disclaimer

Disclaimer: In accordance with The Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent information. This article aims to provide accurate and relevant information. However, readers are encouraged to check the facts for themselves and seek professional advice before making any decisions based on this content.